The Bureau of Economic Analysis (BEA) recently released a report stating that during 2015, new foreign direct investments into the U.S. hit an all-time high of $420.7 billion. Have you ever wondered how the BEA is able to determine this amount? Well the BEA has a number of surveys that businesses and individuals may be required to comply with to notify the BEA of their U.S. direct investments abroad and their foreign direct investments into the U.S. from abroad. The BEA recently modified the reporting requirements for some of these surveys making them mandatory. This recent change along with penalties that could exceed $10,000, it is important that multinational entities and individuals who are involved in cross-border investing be aware of the reporting requirements. In this blog we will discuss the reporting requirements for those investing money into the U.S..

The Bureau of Economic Analysis (BEA) recently released a report stating that during 2015, new foreign direct investments into the U.S. hit an all-time high of $420.7 billion. Have you ever wondered how the BEA is able to determine this amount? Well the BEA has a number of surveys that businesses and individuals may be required to comply with to notify the BEA of their U.S. direct investments abroad and their foreign direct investments into the U.S. from abroad. The BEA recently modified the reporting requirements for some of these surveys making them mandatory. This recent change along with penalties that could exceed $10,000, it is important that multinational entities and individuals who are involved in cross-border investing be aware of the reporting requirements. In this blog we will discuss the reporting requirements for those investing money into the U.S..

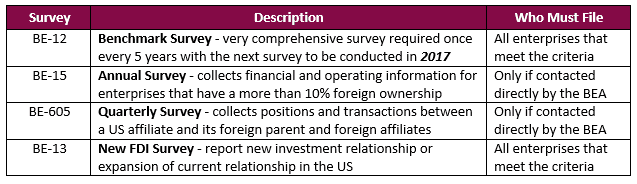

The BEA has four different surveys that U.S. business enterprises in which a foreign person (individual or business) owns 10% or more of voting stock or equivalent interest, may be required to complete. These surveys also apply to non-incorporated business enterprises, such as a U.S. rental property owned by a foreign person. The four surveys are: a benchmark survey, an annual survey, a quarterly survey, and a new FDI survey. Here is a brief summary of each survey, with additional detail discussed later.

BEA FDI Survey Summary

BE-12

The BE-12 is the Benchmark Survey of FDI in the United States and is the most comprehensive survey relating to foreign direct investment. This survey is conducted once every 5 years, with the next survey to be conducted in 2017. The BE-12 is required to be filed regardless of whether the business enterprise is contacted by the BEA or not. There are four versions of the BE-12, depending on your level of total assets, sales or gross operating revenues, or net income.

BE-15

The BE-15 is the Annual Survey of FDI and is used to report annual financial and operating data of U.S. affiliates. The annual survey is only required if the enterprise is contacted directly by the BEA. If you are contacted by the BEA, the survey must be completed by May 31st of each year. Enterprises that are not contacted by the BEA have no reporting responsibilities for the BE-15, even if they meet the reporting criteria. There are four different versions of the BE-15, depending on your level of total assets, sales or gross operating revenues, or net income.

BE-605

The BE-605 is the Quarterly Survey of FDI in the U.S.. The BE-605 is required to report the positions and transactions between a U.S. affiliate and its foreign parent and foreign affiliates. It is also required for any U.S. affiliate that was established, acquired, liquidated, sold, or became inactive during the reporting period. The quarterly survey must be filed within 30 days after the close of the calendar or fiscal quarter, or within 45 days if the report is for the final quarter of the U.S. affiliates financial reporting year. The BE-605 is only required to be filed if the BEA contacts the enterprise individually. Enterprises that are not contacted by the BEA have no responsibility to file the BE-605.

BE-13

The new FDI survey is used when a foreign direct investment relationship is created or when an existing U.S. affiliate of a foreign parent establishes a new legal entity, expands its U.S. operations, or acquires a U.S. business enterprise. The BE-13 is only required to be filed if the cost of the acquisition exceeds $3 million. If that is the case, the survey must be filed no later than 45 days after the date of the investment transaction, whether or not the enterprise was contacted by the BEA. There are six different versions of the BE-13, depending on your specific situations.

There are of course many other surveys that the BEA administers that we did not discuss in this blog as they are very industry specific. For example, the BE-120 and BE-125 are surveys of transactions in selected services with foreign persons and one of those selected services defined by the BEA is accounting, auditing, and bookkeeping services. So depending on a U.S. accounting firm’s level of income from foreign persons, they may be required to file one of these surveys.

As the BEA, IRS, and other U.S. agencies ramp up their focus on tracking FDI it is important that businesses and individuals be aware of their reporting requirements. If you have any questions or need assistance in preparing a BEA survey, please contact our International Tax Team at 302-225-0600.

Photo by Taber Andrew Bain (License)